The Super Project 4h6z3x

This document was ed by and they confirmed that they have the permission to share it. If you are author or own the copyright of this book, please report to us by using this report form. Report l4457

Overview 6h3y3j

& View The Super Project as PDF for free.

More details h6z72

- Words: 921

- Pages: 5

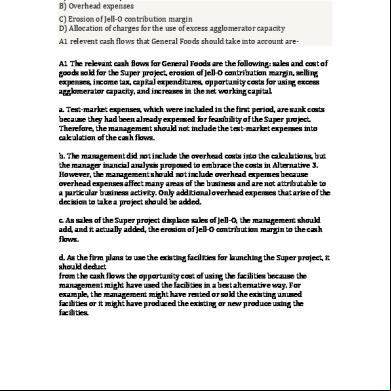

The Super Project General Foods Corporation is a food company involved in the business of producing ingredients for the dessert market. They currently have three categories of products – powders, mixes and ice creams. The powder division produces two products – JellO and Tasty. They are looking to introduce a new powder – Super. Crosby Sanberg, manager – financial analyst, is tasked with the job of analyzing the profitability of the new project and his opinion is that the incremental analysis doesn’t always work for the profitability of the project. Super falls under a significant and growing segment, potentially increasing dessert market share by 10% - 80% from new market and 20% from erosion of Jell-O sales. The project will require Capital Expense of $200,000 ($80K for building modification and $120K for packaging machinery), $15,000 as startup cost, and test market expense of $360K, which has already incurred prior to fund allocation. Super is discussing whether it will also incur an opportunity cost ($453K) by utilizing some of the existing facilities from Jell-O product – building and agglomerator. Finally, there’s discussion about allocating some overhead costs, starting in year 5 after initiation. These overhead costs are categorized as Capital ($40K) and Expenses – on a per unit basis. There are certain pre-planned overhead costs (Alternative III - Discussion) planned for year 1968, and if approved, Super will benefits from this investment. Based on positive NPV, IRR much higher than WACC, and 9 year payback time period, General Foods should launch the new product line. In order to calculate the key metrics, following assumptions were made. Items NOT included as part of Free Cash Flow calculations:

Test Market Expenses: are sunk costs and cannot be recovered, regardless of approval of Super. Opportunity Cost: for building and agglomerator is not considered incremental. Moreover, they are not generating any rental income that will potentially be lost due to Super. Overhead Capital: ($40K) for distribution systems, is based on the theory that a number of individual decisions towards further expansion will result in more fixed costs and facilities in Year 5. Some of this could be due to introduction of new product lines, and some due to expansion in existing product lines. Since this capital expense isn’t incremental to Super project alone, they should be considered as part of Free Cash Flow calculations for future projects alone – whether for new product or for expansion of existing product lines.

Pre-planned expenses: The overhead costs are pre-planned and are expected regardless of approval of Super. They will result in additional capacity, which can be used for subsequent projects (if Super is not approved)

Following Costs should be taken into consideration, while calculating Free Cash Flow.

Overhead Expense: in year 5 (Alternative III – Method) will be incremental only because of Super product. This SG&A expense won’t be realized if the company decides to kill this project. Jell-O Erosion: Since 20% of sales of Super were to come from erosion of the sales of an existing product, those erosions should be taken as a cost for the project. If Super is launched, this revenue will be lost – incremental cost.

Considering the costs of the project, we can estimate the net operating profit of the project (Exhibit 1). Combining the net operating profits of the project with the various costs required at different stages along with the correct classification of expenses, we can estimate the free cash flows of the project. Based on the estimates, an estimated 10 year project life, no salvage value at maturity and a 10% cost of capital, we can calculate the different measures of profitability of project: 1. NPV of the project: $891K 2. IRR of the project: 23.3% 3. Payback period of the project: 9 years Based on the history, the firm has paid between 8.4% and 10.1% dividends on the common shares. Since this project shows a return rate of over 20% (beats hurdle rate by all 3 measures at 10% cost of capital), this project is more profitable than the usual business of General Foods Corporation. The past projects at General Foods Corporation have resulted in unexpected increases in costs. The risks involved in the project are:

Much of the profitability of the project lies in deploying under-utilized resources. Unexpected expansion in existing products could lead to competition for resources which will alter the company profitability A forecasting error in sales can alter the return rate on the project Over the long run, variable costs may increase as a result of volume increase and this may result in a lower rate of return than what is being displayed, so Super may not be a long term profit generator. The incremental investment in the packaging and machinery is specific to Super and may pose a risk if they cannot be used to generate other products

Revenue growth may be limited or stagnant if Super cannibalizes other products as in that case, the revenue will shift from the other products but not increase overall.

Considering the risks, if the company doesn’t have an alternate profitable project in the pipeline to utilize the existing resources, the Super project is a good choice to increase the returns for the shareholder’s equity. Moreover, Super project is a good strategic fit for General Food’s Dessert product line. The case presents evidence that powdered desserts constituted a significant and growing segment, so any project that strengths leadership in existing market segment should be worth investing.

Test Market Expenses: are sunk costs and cannot be recovered, regardless of approval of Super. Opportunity Cost: for building and agglomerator is not considered incremental. Moreover, they are not generating any rental income that will potentially be lost due to Super. Overhead Capital: ($40K) for distribution systems, is based on the theory that a number of individual decisions towards further expansion will result in more fixed costs and facilities in Year 5. Some of this could be due to introduction of new product lines, and some due to expansion in existing product lines. Since this capital expense isn’t incremental to Super project alone, they should be considered as part of Free Cash Flow calculations for future projects alone – whether for new product or for expansion of existing product lines.

Pre-planned expenses: The overhead costs are pre-planned and are expected regardless of approval of Super. They will result in additional capacity, which can be used for subsequent projects (if Super is not approved)

Following Costs should be taken into consideration, while calculating Free Cash Flow.

Overhead Expense: in year 5 (Alternative III – Method) will be incremental only because of Super product. This SG&A expense won’t be realized if the company decides to kill this project. Jell-O Erosion: Since 20% of sales of Super were to come from erosion of the sales of an existing product, those erosions should be taken as a cost for the project. If Super is launched, this revenue will be lost – incremental cost.

Considering the costs of the project, we can estimate the net operating profit of the project (Exhibit 1). Combining the net operating profits of the project with the various costs required at different stages along with the correct classification of expenses, we can estimate the free cash flows of the project. Based on the estimates, an estimated 10 year project life, no salvage value at maturity and a 10% cost of capital, we can calculate the different measures of profitability of project: 1. NPV of the project: $891K 2. IRR of the project: 23.3% 3. Payback period of the project: 9 years Based on the history, the firm has paid between 8.4% and 10.1% dividends on the common shares. Since this project shows a return rate of over 20% (beats hurdle rate by all 3 measures at 10% cost of capital), this project is more profitable than the usual business of General Foods Corporation. The past projects at General Foods Corporation have resulted in unexpected increases in costs. The risks involved in the project are:

Much of the profitability of the project lies in deploying under-utilized resources. Unexpected expansion in existing products could lead to competition for resources which will alter the company profitability A forecasting error in sales can alter the return rate on the project Over the long run, variable costs may increase as a result of volume increase and this may result in a lower rate of return than what is being displayed, so Super may not be a long term profit generator. The incremental investment in the packaging and machinery is specific to Super and may pose a risk if they cannot be used to generate other products

Revenue growth may be limited or stagnant if Super cannibalizes other products as in that case, the revenue will shift from the other products but not increase overall.

Considering the risks, if the company doesn’t have an alternate profitable project in the pipeline to utilize the existing resources, the Super project is a good choice to increase the returns for the shareholder’s equity. Moreover, Super project is a good strategic fit for General Food’s Dessert product line. The case presents evidence that powdered desserts constituted a significant and growing segment, so any project that strengths leadership in existing market segment should be worth investing.