Economics Ia Microeconomics 261gf

This document was ed by and they confirmed that they have the permission to share it. If you are author or own the copyright of this book, please report to us by using this report form. Report l4457

Overview 6h3y3j

& View Economics Ia Microeconomics as PDF for free.

More details h6z72

- Words: 775

- Pages: 4

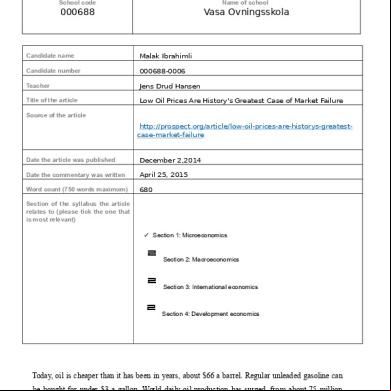

IB Economics—internal assessment coversheet School code

Name of school

000688

Vasa Ovningsskola

Candidate name

Malak Ibrahimli

Candidate number

000688-0006

Teacher

Jens Drud Hansen

Title of the article

Low Oil Prices Are History's Greatest Case of Market Failure

Source of the article

http://prospect.org/article/low-oil-prices-are-historys-greatestcase-market-failure

Date the article was published

December 2,2014

Date the commentary was written

April 25, 2015

Word count (750 words maximum)

680

Section of the syllabus the article relates to (please tick the one that is most relevant)

✓ Section 1: Microeconomics

Section 2: Macroeconomics

Section 3: International economics

Section 4: Development economics

Today, oil is cheaper than it has been in years, about $66 a barrel. Regular unleaded gasoline can be bought for under $3 a gallon. World daily oil production has surged, from about 75 million barrels in 1999—when peak oil predictions were popular—to more than 90 million barrels today. Estimated reserves keep increasing, as well. Cheap oil promotes increased use of carbon fuels at a

time when we should be investing massively in substitutes. Politicians, price oil and gas based on current demand and supply, and not based on the costs to the planet in pollution, global climate change, sea level rise, and more. This, as some refer to it, can be history’s greatest case of market failure. Both consumers and suppliers benefit from the fall in oil prices, however this harms the environment. Now, when suppliers can supply more at the same price, they cause even more damage. Moreover, it does not cost them anything. Damage they cause can include pollution of water resources and contamination of the soil. This in turn, leads to market failure. A market failure is a situation where free markets fail to allocate resources efficiently. In this case, all of us indirectly suffer from the consequences of fall in oil price. Supply curve is showing the different amounts of a product suppliers are willing to provide at different prices. The law of supply states that, “as the price of a product raises, the quantity supplied of a product will usually increase, ceteris paribus”. Meaning that the supply curve usually represents positive relationship between price and quantity of a product.

However, there are some exceptional cases where this relationship becomes negative. Meaning that price decreases as the quantity increases. In other words, the more you have of something, the less value it has. We are going to analyze one of such examples.

After the “peak oil” when we were told that oil and other carbon fuels are becoming scarce, the prices rose and the quantity supplied increased. Profits earned from these high prices were invested into new technologies and new ways of extracting oil and gas. Use of new technology made it easier to obtain oil, and cost of production decreased. As a result, this situation made oil producing firms-revenue maximizers. They sell as much as possible without making a loss. Lower cost of production means that businesses could supply more at each price. This what makes the supply curve to slope downwards from left to right.

As we see on the graph, the decrease in price leads to an increase in quantity. This situation can be used as an evidence for the negative relationship between price and quantity, which sometimes occurs in a supply curve.

The results of lower production cost are usually the same in all the oil-producing countries. Oil producers decide to produce more at lower costs. However, in Saudi Arabia for example, the production has been cut back as a response to falling oil prices. This means that we cannot generalize the consequences of falling oil prices in the USA to all the other countries. If we look at short-term and long-term consequences of falling oil prices, we can say the following. In short-term low oil, prices can have negative impact on economy. Companies need to employ thousands of people, make big investments to build pipelines and to buy new technology. In the long-term, however the results are more positive. We can explain this using the formula for the total cost, which is found by adding variable and fixed costs. In the long run, oil-producing companies have fixed costs only. Therefore, they have fewer expenses then. However, there can

also be some serious economic problems, as well as oil shortage, and environmental damage if prices remain low for too long. Examples of countries, who suffer from low oil prices by these means, are Russia, Venezuela, and Iran.

The supply theory is very useful in economics, but some cases contradict this theory. One of such examples is oil production industry, which demonstrates negative relationship between the price and quantity produced.

Name of school

000688

Vasa Ovningsskola

Candidate name

Malak Ibrahimli

Candidate number

000688-0006

Teacher

Jens Drud Hansen

Title of the article

Low Oil Prices Are History's Greatest Case of Market Failure

Source of the article

http://prospect.org/article/low-oil-prices-are-historys-greatestcase-market-failure

Date the article was published

December 2,2014

Date the commentary was written

April 25, 2015

Word count (750 words maximum)

680

Section of the syllabus the article relates to (please tick the one that is most relevant)

✓ Section 1: Microeconomics

Section 2: Macroeconomics

Section 3: International economics

Section 4: Development economics

Today, oil is cheaper than it has been in years, about $66 a barrel. Regular unleaded gasoline can be bought for under $3 a gallon. World daily oil production has surged, from about 75 million barrels in 1999—when peak oil predictions were popular—to more than 90 million barrels today. Estimated reserves keep increasing, as well. Cheap oil promotes increased use of carbon fuels at a

time when we should be investing massively in substitutes. Politicians, price oil and gas based on current demand and supply, and not based on the costs to the planet in pollution, global climate change, sea level rise, and more. This, as some refer to it, can be history’s greatest case of market failure. Both consumers and suppliers benefit from the fall in oil prices, however this harms the environment. Now, when suppliers can supply more at the same price, they cause even more damage. Moreover, it does not cost them anything. Damage they cause can include pollution of water resources and contamination of the soil. This in turn, leads to market failure. A market failure is a situation where free markets fail to allocate resources efficiently. In this case, all of us indirectly suffer from the consequences of fall in oil price. Supply curve is showing the different amounts of a product suppliers are willing to provide at different prices. The law of supply states that, “as the price of a product raises, the quantity supplied of a product will usually increase, ceteris paribus”. Meaning that the supply curve usually represents positive relationship between price and quantity of a product.

However, there are some exceptional cases where this relationship becomes negative. Meaning that price decreases as the quantity increases. In other words, the more you have of something, the less value it has. We are going to analyze one of such examples.

After the “peak oil” when we were told that oil and other carbon fuels are becoming scarce, the prices rose and the quantity supplied increased. Profits earned from these high prices were invested into new technologies and new ways of extracting oil and gas. Use of new technology made it easier to obtain oil, and cost of production decreased. As a result, this situation made oil producing firms-revenue maximizers. They sell as much as possible without making a loss. Lower cost of production means that businesses could supply more at each price. This what makes the supply curve to slope downwards from left to right.

As we see on the graph, the decrease in price leads to an increase in quantity. This situation can be used as an evidence for the negative relationship between price and quantity, which sometimes occurs in a supply curve.

The results of lower production cost are usually the same in all the oil-producing countries. Oil producers decide to produce more at lower costs. However, in Saudi Arabia for example, the production has been cut back as a response to falling oil prices. This means that we cannot generalize the consequences of falling oil prices in the USA to all the other countries. If we look at short-term and long-term consequences of falling oil prices, we can say the following. In short-term low oil, prices can have negative impact on economy. Companies need to employ thousands of people, make big investments to build pipelines and to buy new technology. In the long-term, however the results are more positive. We can explain this using the formula for the total cost, which is found by adding variable and fixed costs. In the long run, oil-producing companies have fixed costs only. Therefore, they have fewer expenses then. However, there can

also be some serious economic problems, as well as oil shortage, and environmental damage if prices remain low for too long. Examples of countries, who suffer from low oil prices by these means, are Russia, Venezuela, and Iran.

The supply theory is very useful in economics, but some cases contradict this theory. One of such examples is oil production industry, which demonstrates negative relationship between the price and quantity produced.